-

Other

-

Easy Excel Bookkeeping

Instant Excel bookkeeping without any macros or VBA code.

For bookkeeping beginners

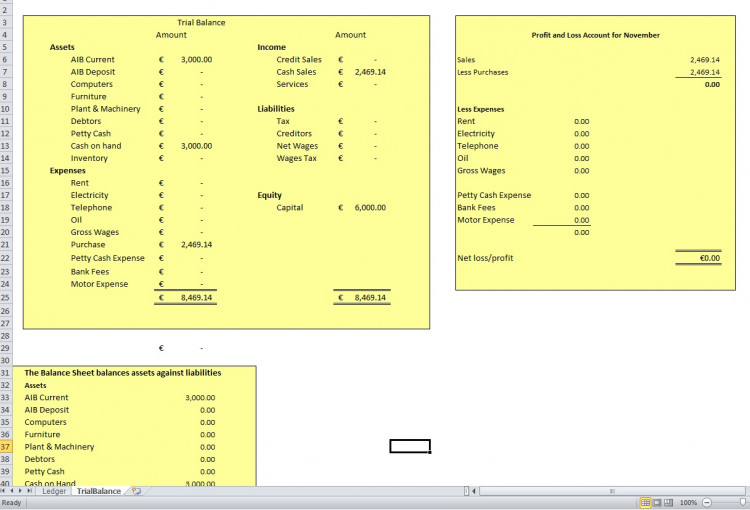

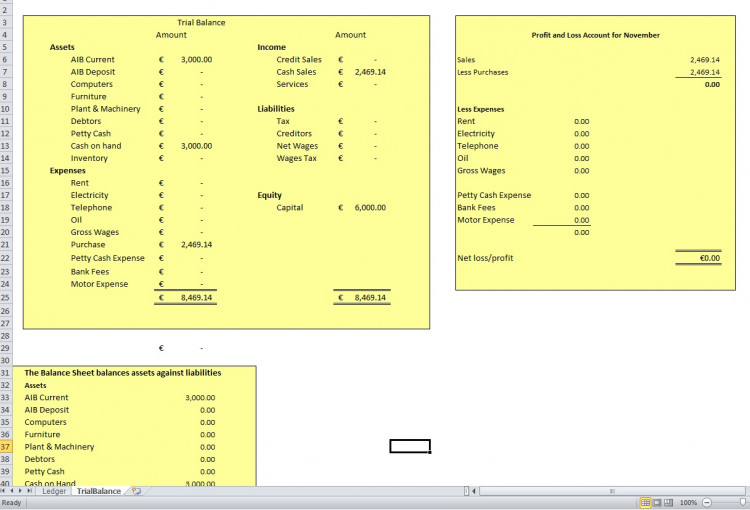

There are two sheets in this workbook: Ledger and TrialBalance.

The Ledger sheet is arranged in the traditional T format for double entry bookkeeping.

The TrialBalance sheet calculates its results from the Ledger sheet.

This excel workbook is just a teaching aid to help students understand how debits and credits work.

In accounting there are only 5 major accounting groups:

Assets

Expenses

Equity,

Income

Liabilities.

You can have hundreds of accounts in the General Ledger, but each account belongs to one of these 5 main groups. Once you know which group an account belongs to then it is easy to understand which account to debit and which to credit.

Debits and Credits work the same way for accounts in the Assets and Expenses groups; A debit increases the amount in the account, a Credit reduces it. But debits and credits work the opposite way for the other 3 groups: Liabilities, Income and Equity; For example, debit will reduce a liability, and a credit will increase it.

On the left-hand side of the T line you select the account to debit in the “Account Type” column. A drop down box will allow you to pick the account. Then enter the amount in in the next column.

On the right-hand side of the T line select the account to credit and enter the amount. Debits and credit amounts must match. You can have a triple entry transaction too. For example if you purchased goods for a business worth 1,000 at 21.5% tax. On the left-hand side of the T line debit the Purchases expense account with the net value 823.25 then debit the Tax account with 176.95, which is the tax repayable to you by revenue. This adds to 1,000. Then balance the transaction by crediting the AIB current account with 1,000 on the right-hand side of the T line.

Switch to the TrialBalance sheet to observe the result.

The TrialBalance sheet shows:

1. The Trial Balance

2. The Profit and Loss statement

3. The Balance Sheet

Michael Finnegan, Ireland.

Friday 28 November 2014

Note: Due to the size or complexity of this submission, the author has submitted it as a .zip file to shorten your download time. After downloading it, you will need a program like Winzip to decompress it.

Virus note: All files are scanned once-a-day by SourceCodester.com for viruses, but new viruses come out every day, so no prevention program can catch 100% of them.

FOR YOUR OWN SAFETY, PLEASE:

1. Re-scan downloaded files using your personal virus checker before using it.

2. NEVER, EVER run compiled files (.exe's, .ocx's, .dll's etc.)--only run source code.