Payroll System: How to Compute Withholding Tax

On my last post I submitted projects that will Compute SSS on a Payroll System.

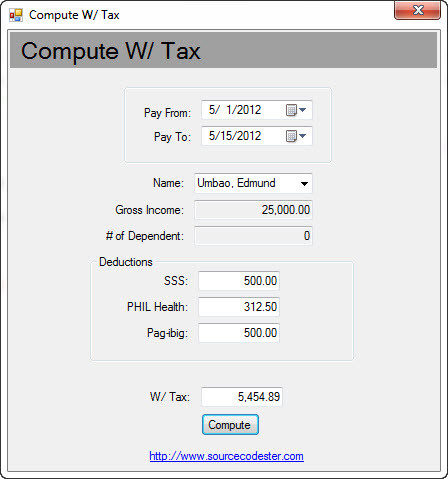

This time you’ll learn on how to compute Withholding Tax based on the Withholding Tax table as revised for January 2009.

Withholding tax is computed based on gross pay minus deductions like SSS, PHIC, & Pag-ibig contribution. For complete information on the manual computation please visit http://philippinestaxcomputation.blogspot.com/.

The value of SSS, PHIC, & Pag-ibig is based on estimated value. To get the exact SSS contribution, download the sample code at Payroll System: How to Compute SSS.

Note: Due to the size or complexity of this submission, the author has submitted it as a .zip file to shorten your download time. After downloading it, you will need a program like Winzip to decompress it.

Virus note: All files are scanned once-a-day by SourceCodester.com for viruses, but new viruses come out every day, so no prevention program can catch 100% of them.

FOR YOUR OWN SAFETY, PLEASE:

1. Re-scan downloaded files using your personal virus checker before using it.

2. NEVER, EVER run compiled files (.exe's, .ocx's, .dll's etc.)--only run source code.