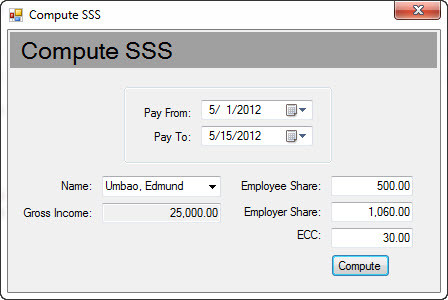

Payroll System: How to Compute SSS

Are you struggling on how to compute the SSS of the employee based on the “Schedule of SS and EC Contributions” table? This project will let you compute the Employee Share, Employer Share, and EC based on the gross income of the employee.

The SSS Contribution is computed semi-monthly. The gross income is divided into two and the 2nd half of the month is computed based on the 1st half of the month to get the exact deduction for the whole month.

For example if the contribution of the employee for the whole month is 133.30 and he/she is deducted 100.00 for the 1st half of the month then his/her 2nd half should be 33.30 to get 133.30.

The Schedule of SS and EC Contributions is saved in the database for easy retrievable. This is useful if the table is change and can be edited easily.

If you want the whole programs that also compute PhilHealth, Pag-ibig, and W/Tax please don’t hesitate to contact me. You may also download my simple Payroll System.

Note: This computation of SSS contribution is applicable only in the Philippines.

Note: Due to the size or complexity of this submission, the author has submitted it as a .zip file to shorten your download time. After downloading it, you will need a program like Winzip to decompress it.

Virus note: All files are scanned once-a-day by SourceCodester.com for viruses, but new viruses come out every day, so no prevention program can catch 100% of them.

FOR YOUR OWN SAFETY, PLEASE:

1. Re-scan downloaded files using your personal virus checker before using it.

2. NEVER, EVER run compiled files (.exe's, .ocx's, .dll's etc.)--only run source code.

Comments

what is the meaning of ER, EC

what is the meaning of ER, EC, ECC